We are thrilled to announce that RSSA® has been accepted into the AgeTech Collaborative™ from AARP® accelerator program, an 8-week program designed to elevate promising early-stage AgeTech startups.

Post Type Archives: Resources

H.R. 82 Passes Senate: A Historic Step in Social Security Reform

December 21, 2024 — For Immediate Release In a landmark decision, the U.S. Senate has passed H.R. 82, the Social Security Fairness Act of 2023, with a resounding bipartisan vote of 76-20. This legislation repeals two provisions—the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO)—that have long reduced Social Security benefits for public…

Who Should Consult with an RSSA? A Guide to Optimizing Your Social Security Benefits

Norm Haug RSSA Staff Social Security plays a critical role in retirement income planning, but navigating the complex rules and strategies can be overwhelming and you may not realize rules that can affect you. A Registered Social Security Analyst (RSSA) specializes in helping individuals and couples maximize their Social Security benefits by providing personalized,…

Nine States that Tax Social Security in 2024

Pamela Kweller RSSA Staff Tax season has officially begun and it’s crucial to be aware that your Social Security income may be subject to both federal and state taxation. Referred to by some as the Social Security “stealth” tax, many individuals are unaware of this potential tax implication and fail to incorporate it into…

New Commissioner of Social Security Administration

Pamela Kweller RSSA Staff On December 20, 2023, Martin J. O’Malley was sworn in as the new Commissioner of the Social Security Administration. O’Malley replaces Kilolo Kijakazi, who was Acting Commissioner of the Social Security Administration since July 2021. Prior to becoming Commissioner of SSA, O’Malley has served as Governor of Maryland and Mayor…

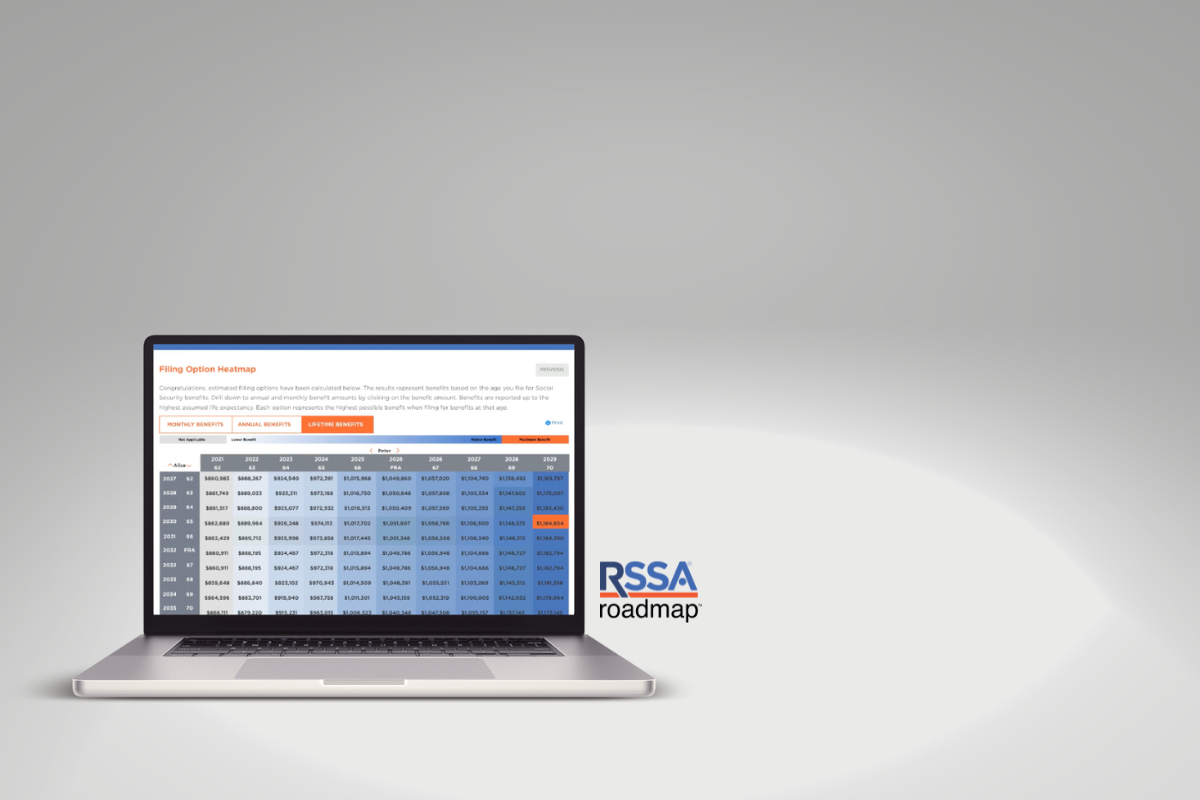

RSSA Launches RSSA Roadmap, Social Security Optimization Software with Live Support

Pamela Kweller RSSA Staff RSSA® has officially unveiled RSSA Roadmap™, providing millions of Americans and retirement professionals with the technology and support to optimize Social Security claiming strategies. The National Association of Registered Social Security Analysts® (RSSA), shared a press release today announcing its new fintech platform, RSSA Roadmap. RSSA Roadmap is a software…

Empowering Communities: The Symbiotic Relationship Between RSSA, Social Security, and Credit Unions

In the ever-evolving landscape of financial services, credit unions have emerged as beacons of community support and financial guidance. At the heart of this support system lies a deep understanding of their members’ needs, especially in the realm of retirement planning and Social Security benefits. There is a perfect synergy between Retirement, Social Security knowledge…

Medicare Open Enrollment Has Begun

Medicare’s open enrollment period begins October 15, 2021 and ends on December 7, 2021. You can prepare now with these 3 suggestions.

The 2024 Social Security COLA is 3.2 Percent

Pamela Kweller RSSA Staff The September 2023 Consumer Price Index (CPI) report was released today, providing the final calculation for the 2024 Social Security Cost of Living Adjustment (COLA). And the official 2024 Social Security COLA is 3.2 percent. According to the Social Security Administration, “More than 66 million Social Security beneficiaries will see…

Fiduciary Best Practice: Emphasizing the Role of RSSA in Holistic Financial Planning

Fiduciary Best Practice: Emphasizing the Role of RSSA in Holistic Financial Planning In the realm of financial planning and advisement, the concept of “fiduciary responsibility” stands paramount. A fiduciary must act in the best interests of their clients, making decisions that best serve their clients’ financial well-being. Given this solemn responsibility, how can an advisor…