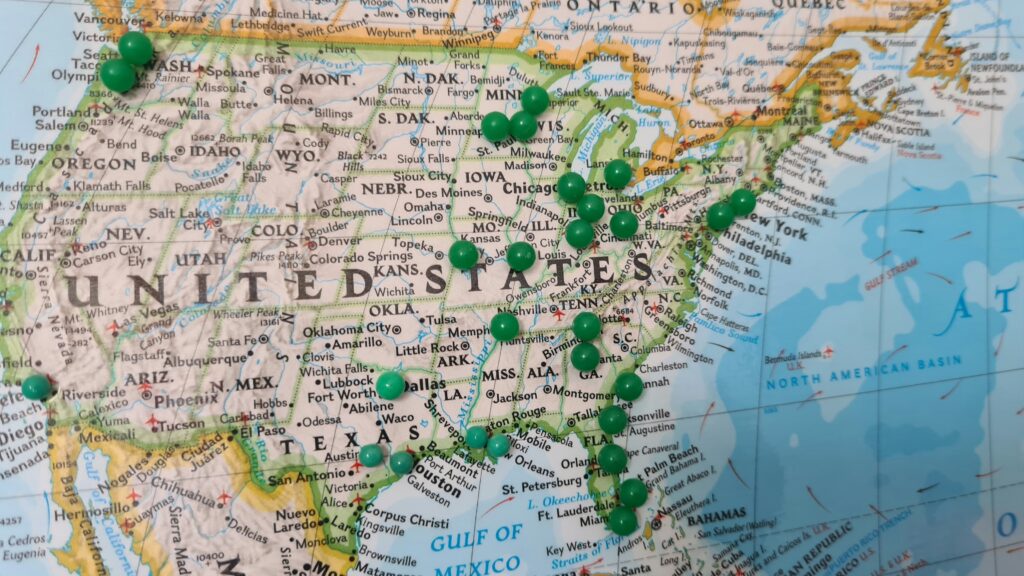

NARSSA has announced that it has expanded its nationwide network of nearly 2,000 field locations where Americans can seek both in-person and remote access to certified Social Security experts. Known as Registered Social Security Analysts (RSSA®), these experts provide additional...

December 10, 2025 Quick Updates

What Is the Social Security COLA for 2027?

December 22, 2025 | U.S. News & World Report

December 16, 2025 | MarketWatch

December 10, 2025 | Press Release

Social Security Fairness Act Payments: What You Need to Know

December 8, 2025 | BottomLineInc

Don't miss important Social Security updates. Subscribe to our free monthly newsletter for the latest Social Security news, delivered straight to your inbox.