The RSSA Team

April 24, 2020 News & Updates

Pamela Kweller RSSA Staff

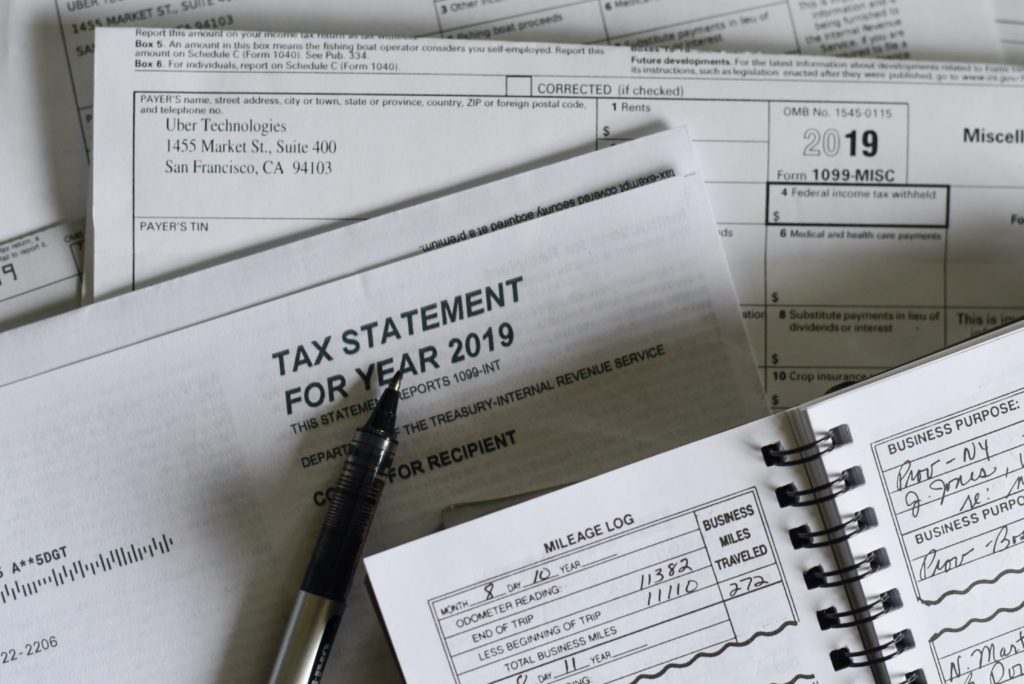

On Friday March 27, 2020 the President signed the $2 trillion CARES Act, H.R. 748. One of its many significant provisions is the distribution of economic impact payments also known as stimulus checks.

Many Americans will receive this one-time payment to help alleviate financial struggle and to help stimulate the economy. Individuals will receive up to $1,200 and joint-filers will receive up to $2,400. An additional $500 will be provided for each child under 17 years of age. The amount received, if any, is dependent on several factors including but not limited to your 2018 (or 2019) tax return as well as your Adjusted Gross Income (AGI). The amount received will be reduced if your AGI is above $75,000 (or $150,000 for joint filers).

Over the last few weeks, there have been many myths floating around about stimulus checks. Here are some truths.

For more questions regarding stimulus checks, visit the Economic Impact Payment Information Center