The NARSSA Team

June 5, 2025 Planning

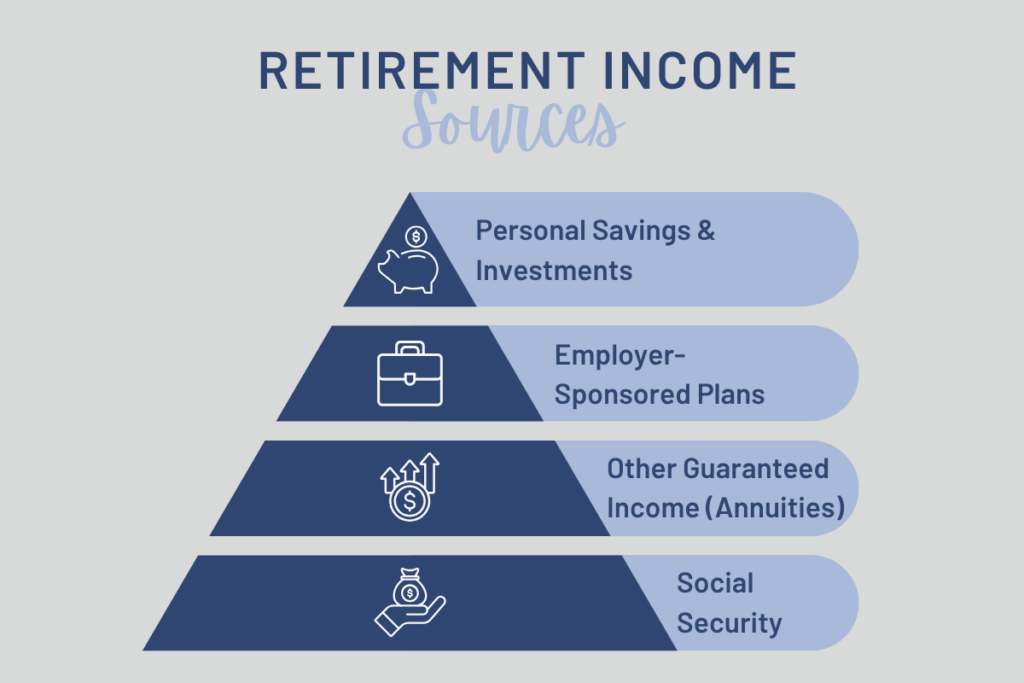

For many Americans, Social Security is the foundation of retirement income, but it’s rarely enough on its own. That’s where annuities can play a vital role. Like Social Security, annuities provide a guaranteed stream of income for life, helping retirees cover essential expenses and guard against longevity risk.

This month, we’re highlighting how Social Security and annuities can work together to create a stronger, more secure retirement plan.

Social Security: The Foundation of Retirement Income

According to the SSA’s latest fact sheet:

-Social Security benefits make up about 31% of income for people over age 65.

-Among beneficiaries age 65 and older, 39% of men and 44% of women receive half or more of their income from Social Security.

-12% of men and 15% of women rely on Social Security for 90% or more of their income.

Social Security is the largest and most stable layer of retirement income—reliable, inflation-adjusted, and guaranteed for life. But for many retirees, it’s only the starting point.

Filling the Gap with Annuities

With rising healthcare costs and longer life expectancies, many individuals need additional income sources to maintain financial security in retirement. Annuities can help fill that gap by providing predictable, lifelong income that complements Social Security benefits.

Helping Clients See the Full Picture

Registered Social Security Analysts (RSSAs) guide clients through optimized claiming strategies, while helping them see how Social Security fits into their broader retirement income plan, including options like annuities.

A secure retirement starts with smart planning. And it starts with Social Security.