Martha Shedden, RSSA®

May 5, 2020 In the News

Martha Shedden RSSA President & Co-Founder

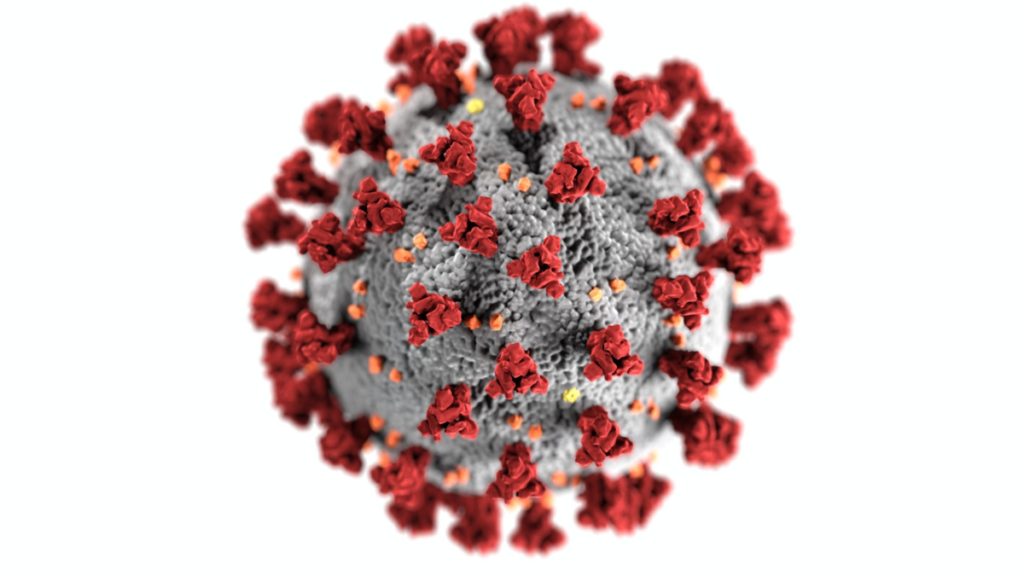

The sudden shift in our work habits, whether losing a job, working from home or worrying about your safety as you continue your essential work, is compounded by dire personal financial circumstances due to the COVID-19 pandemic. Depending on individual situations, workers approaching retirement age have come to some surprising realizations.

Some people have discovered they want to retire soon. They have discovered the freedom that retirement can offer and say, “enough is enough.” The thought of returning to the daily grind of long commutes, days spent in a cubicle dealing with office politics and interminable meetings of questionable value, is just too much to bear. It’s time to retire.

Others have realized they don’t really want to retire for a long time, or maybe at all. The total freedom of working at home is “not all I thought it would be.” The boredom and responsibility of scheduling your day and completing tasks without the familiar 9 to 5 structure can be a shock. They can’t wait to get back to their old routine and may not retire as early as they thought.

Whichever of these scenarios sounds familiar, you’re not alone. And for both, it is a wake-up call to plan for your retirement by speaking with a Registered Social Security Analyst (RSSA®).

A survey of nearly 100,000 households was conducted the first week of April by three economics and finance professors and approximately 9,500 households responded to questions about job losses.

Millions of those who have lost their jobs in the last two months aren’t coming back, according to new research. According to the U.S. Labor Department, prior to the crisis, people over age 55 accounted for 43 million workers, or one quarter of the entire labor force.

“We see a large increase in those who claim to be retired,” wrote economics professors Olivier Coibon of the University of Texas at Austin and Yuriy Gorodnichenko of the University of California at Berkeley and finance professor Michael Weber of the University of Chicago’s Booth School of Business.

“This makes early retirement a major force in accounting for the decline in the labor-force participation…. [it] suggests that the onset of the Covid-19 crisis led to a wave of earlier than planned retirements.”

The professors believe about 8% of the U.S. population had lost their jobs between January and early April, equivalent to about 20 million people, larger than the new unemployment claims seen over that period. But the numbers actively looking for work aren’t anywhere near the same amount because of people dropping out of the labor force.

Many of those approaching retirement will wait out the crises and return to work, but many others hope they won’t.

Remember, retiring early doesn’t necessarily mean collecting Social Security benefits early. For those who can afford to wait, delaying claiming Social Security benefits can pay off with an increase of up to 8% every year they wait up to age 70.

Schedule a consultation with a Registered Social Security Analyst before making a Social Security claiming decision you may regret later.

Another study conducted in March by SimplyWise, a New York City retirement planning firm, examined how the COVID-19 crisis was causing delays in planned retirement.

The COVID-19 crisis has given many workers a glimpse of what retirement life may look like and their readiness for that change. For some, this time of being forced to stay home has been welcomed.

For others, it can be lonely and boring if they don’t have something to fill their time. They’ve come to realize that being active, working and staying busy are their priorities.

The word “retirement” doesn’t mean what it did in the past. Many of today’s seniors want to continue working, perhaps only part-time, and the possibility of working from home may be the answer to their retirement plan.

“In retirement, unless you have established another occupation or volunteer position, you have nothing to do but putter around the house, read books, watch TV or chase information on the internet,” says Dr. Guy Baker of Wealth Teams Alliance in Irvine, California. “Forced captivity from the ‘Stay Safe at Home’ is similar because normal activities are suspended and you have no real control over the outside environment. So, you are forced to be inactive. Very similar to a poorly planned retirement.”

Perhaps a very small silver lining in this unprecedented time of catastrophic illness and death, job loss, and economic uncertainty, has been the ability to really learn what matters most in life.

As you move forward, it is within your power to create the retirement that fits you. Start by scheduling an appointment with a Registered Social Security Analyst.

Opinion: COVID-19 crisis sparks ‘early retirement’ wave April 30, 2020, Brett Arends https://www.marketwatch.com/story/covid-19-crisis-sparks-early-retirement-wave-2020-04-30?mod=article_inline

Will ‘Staying Safe at Home’ Boredom Cause You To Avoid Retirement? April 19, 2020, Chris Carosa https://www.forbes.com/sites/chriscarosa/2020/04/19/will-staying-safe-at-home-boredom-cause-you-to-avoid-retirement/#6040d630268e